total property tax in frisco tx

Taxing units set their tax rates in August and September. Frisco Office 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034 taxassessorcollincountytxgov 4693625800.

Celebrity Listing Alert Once Owned By Arnold Schwarzenegger And Maria Shriver This Gated Pacific Palisad Celebrity Houses Luxury Real Estate California Homes

Taxes in Frisco Texas are 131 more expensive than Plano Texas.

. Property Taxes No Mortgage 50116900. Find All The Record Information You Need Here. One important factor in home affordability in Frisco Texas is your Frisco Texas property taxes.

Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Unsure Of The Value Of Your Property. Ad Online access to property records of all states in the US.

Overall the total taxable value of property within Frisco ISD rose 67 from 2020 to 2021 to 4658 billion. Frisco as well as every other in-county public taxing unit can at this point compute required tax rates since market value totals have been recorded. Purefoy Municipal Center Frisco City Hall 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034 Map.

Frisco Property Tax Collections Total Property Taxes. Property Tax Rate to Drop Another Four Cents Sep 14 2021. The median property tax in Collin County Texas is 4351 per year for a home worth the median value of 199000.

Frisco City Council intends to keep the citys current property tax rate of 04466 per 100 valuation steady for the upcoming 2020-21 fiscal year. Frisco Tax Rates for Collin County. The state establishes the total amount of state and local funding due to school districts under Texas school finance law.

Monday - Friday 8 am. Here is some information about the current Frisco property taxes. Historic Preservation Tax Incentive Program.

Property taxes are local taxes. City of Frisco Base Property Tax Rate. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

The average lot size on. 469-362-5800 Hours Monday through Friday 8 am. Property taxes in Texas are ad valorem meaning they are based on the 100 assessed value of the property.

The year-over-year appreciation of existing property including residential commercial land improvements and more was 16 in Collin County and 39 in Denton County. Find property records tax records assets values and more. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

When added together the property tax load all owners support is established. Hotel Motel Tax. Thus its mainly all about budgeting first setting an annual expenditure total.

View details map and photos of this single family property with 3 bedrooms and 2 total baths. Name Denton County Tax Collector - Frisco Office Address 5533 Farm to Market Road 423 Frisco Texas 75034 Phone 940-349-3510. Address Phone Number and Hours for Denton County Tax Collector - Frisco Office a Treasurer Tax Collector Office at Farm to Market Road 423 Frisco TX.

Over 65 65th birthday 30000. Ad Just Enter your Zip Code for Property Tax Records in your Area. Sales Tax State Local Sales Tax on Food.

Easily Find Property Tax Records Online. Real property tax on median home. Ad Enter Any Address Receive a Comprehensive Property Report.

Cost of Living Indexes. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. RE trans fee on median home over 13 yrs.

Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth. For Sale - 6561 Richmond Dr Frisco TX - 415000. Property Taxes Mortgage 217307500.

Thus its mainly all about budgeting first setting an annual expenditure total. 2007 Exemptions and Property Tax Rates. Leased Vehicle Taxes - City of Frisco.

Denton County Tax Collector - Frisco Office Contact Information. See Results in Minutes. 6101 Frisco Square Boulevard 2nd Floor Frisco TX 75034 Phone.

The tax rates are stated at a rate per 100 of assessed value. Just Enter Your Zip for Free Instant Results. Get FREE FRISCO PROPERTY RECORDS directly from 2 Texas govt offices 2 official property records databases.

6101 Frisco Square Boulevard. All Frisco ISD taxes are collected by the Collin County Tax Office. Expert Results for Free.

Collin County Tax Assessor-Collector Frisco Office.

What Is The Property Tax Rate In Frisco Texas

With Forest City Behind Them The Ratners Rebuild Crain S Cleveland Business Forest City New Downtown City

Beautiful Corner Lot Property In The Sought After Frisco Isd This Home Boasts 4 Beds 3 Baths And 2 Car Garage The K New Home Construction Home Buying Patio

Buying Or Selling Celina Tx Real Estate The Timing Couldn T Be Bette Property Tax Real Estate Dallas Real Estate

Budget And Tax Facts City Of Lewisville Tx

Suburban Castle Grand Homes The Neighbourhood Frisco

21 3 Million Emerald Cay Estate Providenciales Turks And Caicos Islands Spanish Colonial Homes Mansions California Homes

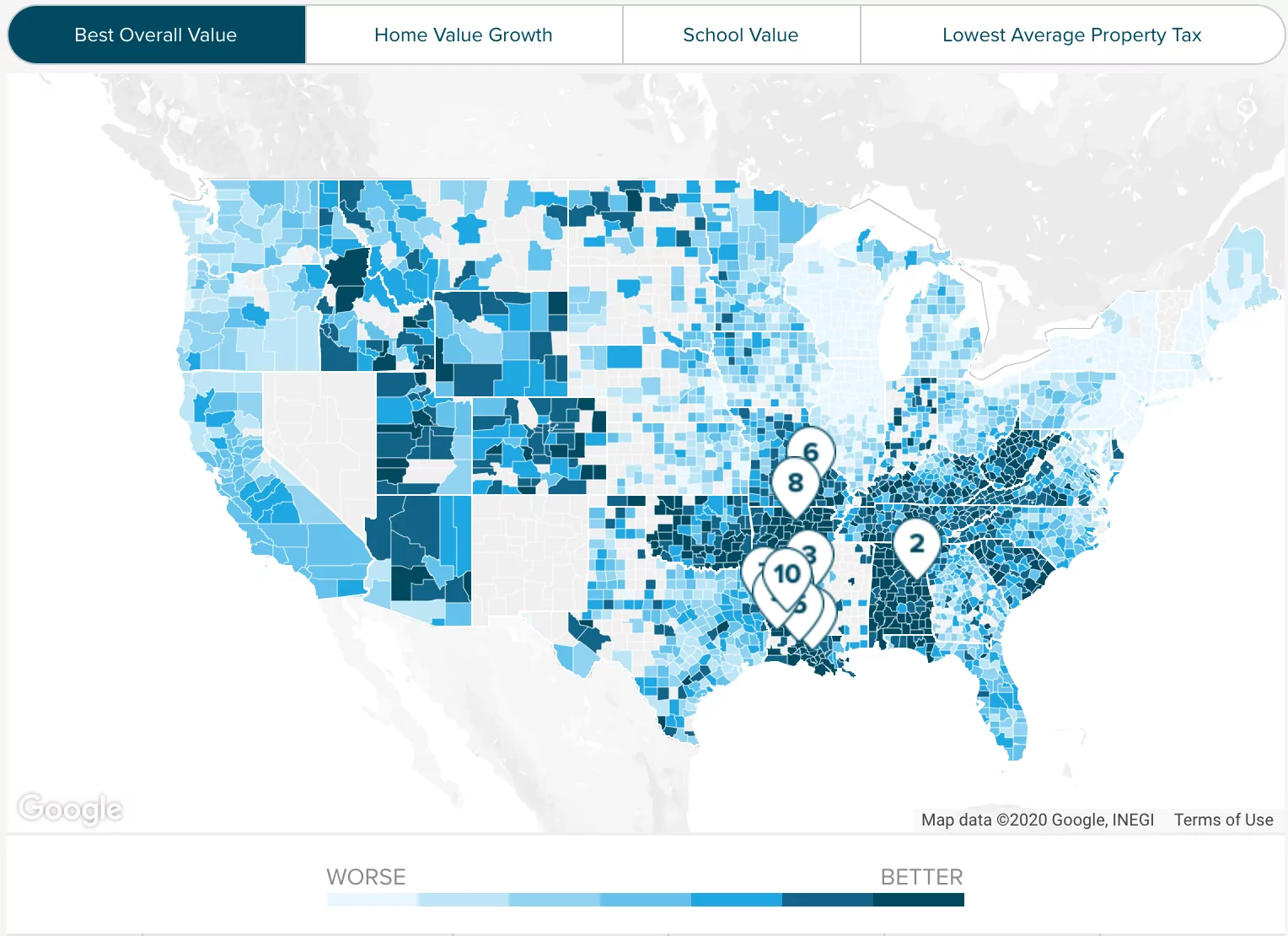

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Donation Envelope Template Check More At Https Nationalgriefawarenessday Com 29767 Donati Envelope Template Envelope Design Template Templates Printable Free

Los Angeles Home Prices At Five Year High Los Angeles Homes House Prices Local Real Estate

Repost Emilio Horton Those Scented Candles And Oils Are The My Whole House Is Smelling Good Great Products St Home Buying Frisco Texas Smell Good

City Journal Takes Note Of Failures Of Dart System Map Dallas Map Map

Buying Or Selling Irving Tx Real Estate The Timing Couldn T Be Bette Dallas Real Estate Real Estate Real Estate Marketing