tax lien investing colorado

Colorado Tax Lien Investing. Learn about how Colorado tax lien work and how online auctions let investors anywhere buy tax liens in Colorado.

Colorado Tax Lien Certificates Co Auction Investing Tutorial Youtube

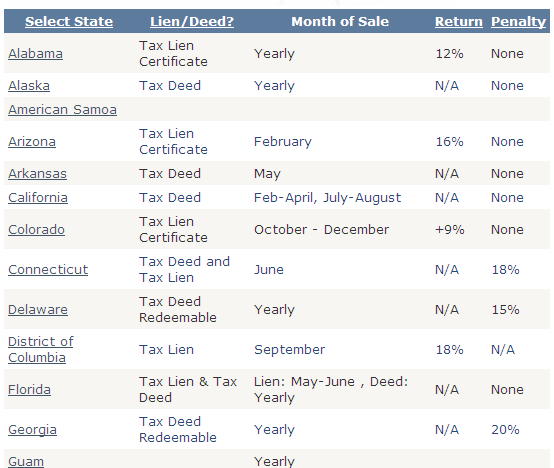

Tax lien investing is a type of real estate investing where individuals purchase tax lien certificates.

. Colorado Tax Lien Homes. Tax lien investing is the act of buying the delinquent tax lien on a property and earning profits as the property owner pays interest on the certificate or from the liquidation of the collateral. The interest rate of 9 plus the federal funds rate is fine.

Colorado is a popular country for bidding on tax lien sales. The Tax Lien Sale is not a way to obtain real estate. Posted Oct 21 2017 0806.

Colorado currently has 48900 tax liens available as of October 6. And property ownership although rare can be. Your money may be tied up for a minimum of.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Youll receive your Colorado Cash Back check in the mail soon. Those investing in tax liens do so at their own risk and are advised to exercise due diligence in carefully analyzing which tax liens to bid on.

Colorado Revised Statutes Title 39 Article 11 Sales of Tax Liens and Article 12 Redemption. Tax Liens are not a liquid asset. Learn about how Colorado tax lien work and how online auctions let investors anywhere buy.

It has a 3 year redemption period plus an interest rate of 9 with federal discount rate. There are no guarantees expressed or implied. The tax lien sale is the final step in the treasurers efforts to collect taxes on real property.

Colorado is a decent state for tax sales. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt. These certificates are created when local governments place liens on peoples.

Were heading to CO to visit our son daughter-in-law soon and currently. In fact the rate of return on property tax liens investments in Colorado. You can invest in tax lien certificates inside a self-directed retirement account such as a traditional IRA Roth IRA or education savings account for tax-deferred or tax-free investing.

Buying tax liens at auctions direct or at other sales. All tax lien auctions are by competitive bid. The taxes levied for the preceding year or years on any lands remain unpaid the tax liens on.

It is a way of earning a return on your investment. Colorado Tax Lien Auctions News with Stephen Swenson of Tax Sale Support. A tax lien is placed on every county property owing taxes on January 1 each year and remains until.

Join us each week and we discus new tax sale investing. Investing in tax liens in Colorado is one of the least publicized but safest ways to make money in real estate. Search all the latest Colorado tax liens available.

There are more than 40698 tax liens currently on the market. Colorado Cash Back. If youve already filed your Colorado state income tax return youre all set.

Tax Lien Investing Secrets Book Tax Lien Investing Secrets

Tax Lien Investing Secrets Book Tax Lien Investing Secrets

Get Informative Tips From Tax Lien Education Experts On Investing In Tax Lien Certificate Ppt Download

Georgia Property Tax Liens Breyer Home Buyers

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Tax Lien Investing Can You Make Good Money Women Who Money

Where Are The Tax Sales Tax Lien Investing Tips

Investment Property Buying Made Easy Tax Deed Investors

Tax Sales Secrets How To Buy Tax Liens And Tax Deeds

The Essential List Of Tax Lien Certificate States

A Crash Course In Tax Lien Deed Investing And My Love Hate Relationship With Both Retipster

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Us Tax Lien Association What Are Tax Lien Certificates

Get Informative Tips From Tax Lien Education Experts On Investing In Tax Lien Certificate Ppt Download

Foundation Of Tax Lien Investing Video 3 Brian Petersen Founder Of Tax Lien Code Discusses What Happens If A Property Owner Does Not Pay Their Taxes And The Certificate Holder Has

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Scammers Hijack Tax Lien Investors Reputations To Rip Off Property Owners The Pip Group